It began publicly trading on Dec 12, 1980 and this is the fifth split. Here is a history of Apple's previous splits and its after effects. For instance, if you own 10 shares of Company X at $10 per share, and the company announces a 1-for-2 reverse stock split, you end up owning five shares of Company X at $20 per share. Usually, reverse stock splits are announced by companies that have low share prices and want to increase them--oftentimes to avoid being delisted.

Apple's fourth and final stock split to date happened on 9 June 2014. This was the most significant of Apple's stock splits, with a seven-to-one ratio taking shares from close to $700 down to around $100. Apple wanted to make shares accessible to more investors, but it's also speculated that they set their sights on inclusion in the Dow Jones Industrial Average index.

This index acts as a benchmark, with 30 stocks included from key economic sectors. As it's a price weighted average, Apple's stock price needed to be reduced before it was feasible for the company to be added. It was announced that Apple would join the Dow Jones in March 2015 and it has been a part of the index since March 2019. In most cases, stock splits are undertaken by companies when the share price has gone up significantly, particularly in relation to a company's stock market peers.

If the share price becomes more affordable for smaller investors, it can reasonably be assumed that more investors will participate, and so the overall liquidity of the stock would increase as well. Does the 4-to-1 stock split mean the value of my AAPL shares will increase four times? The side effect of a stock split is that the increase in shares means every share is now worth less. For example, let's say a company offers a 4-to-1 stock split like Apple is doing, and their share price is $100 before the split. When the stock goes through its 4-to-1 split, every shareholder will have four times the amount of shares, but those shares will only be worth $25 each now. In other words, the stock split doesn't make investors more money.

Companies may go through reverse stock splits to avoid being delisted from a stock exchange if they're nearing the minimum share price allowed on that exchange. They also might do a reverse stock split to improve the company's public image or draw attention from high-profile investors or analysts. The second Apple stock split took place on 21 June 2000, and was also a two-for-one split. Shortly afterwards though, in September 2000, share prices were halved as many technology companies experienced a rapid decline.

This was around the time the dot-com bubble burst, where many companies went out of business and others decreased in value. Apple blamed lower-than-forecast sales, as well as a weaknesses in the education market. While Apple was affected temporarily, the company's shares made a full recovery and went on to achieve new highs. Stock splits remain relevant for companies that want to bring in a wider base of shareholders, especially ones who had been put off by the high share price. Based on today's closing price, after the split Apple's shares would cost $106.26 apiece. Lowering the share price increases demand, especially among retail investors who want to own the stock, but couldn't afford to pay $400 for a single share.

And this is how the existing shareholders benefit from the stock split. Apple's market cap will remain the same before and after the split. Let's say Apple is worth $1 trillion dollars (it's worth more, but let's just use an easily divisible figure for this example).

So in this case, each share of AAPL would be worth $10 billion ($1 trillion/100). (Every one of those previous 100 shares is now four shares.) However, each of those shares is now worth four times less because there are four times more of them. That means the new post-split shares are worth $2.5 billion each. And 400 shares times $2.5 billion equals, you guessed it, $1 trillion dollars—the exact same market cap AAPL had before the split. The stock will undergo a 4-for-1 stock split for those shareholders of record on August 24, 2020.

This means for each share of AAPL held; you will receive three additional shares, while the share price of the stock will be quartered. The shares will undergo the "split" after the market closes on August 28 and officially begin trading with the new share price on August 31. A stock split is a corporate action that companies take to increase the number of outstanding shares and decrease the value of each share. In other words, as a company's stock price increases, investors are rewarded with higher returns. But eventually, the stock may reach a price that makes it difficult for new investors to jump in, which is when the stock split comes in.

The iPhone giant announced after the market closed Thursday that its board approved a 4-for-1 stock split for every shareholder of record at the close of business on August 24. This means each Apple shareholder will receive three additional shares for every share held. Shares will begin trading on a split-adjusted basis on Aug. 31. For example, a $1 increase in a lower-priced stock can be negated by a $1 decrease in a much higher-priced stock, even though the lower-priced stock experienced a larger percentage change. In addition, a $1 move in the smallest component of the DJIA has the same effect as a $1 move in the largest component of the average.

The surge in splits comes amid a rally that's pushed share prices of almost 600 stocks in the Russell 3000 Index above $100. Yet that has done little to settle the age-old-argument among investors about whether such stock-price engineering has any bearing on performance. In fact, recent developments such as soaring retail trading and fractional share ownership have only heated things up.

In the case of reverse stock splits, the company divides the number of shares that investors own, rather than multiplying them. When looking at the value of a company's shares, it can be difficult to interpret how successful the company has been based on its stock prices following a split. Apple's current share price of around $408 doesn't look as impressive as it would have done ahead of its four stock splits. To be clear, stock splits do not change a company's underlying fundamentals. And though the lower-priced shares can attract smaller investors, larger investors already trading the shares can maintain more influence over the price action.

The overall market environment is key, as well, and it has influenced trading after the limited number of previous Apple stock splits. Apple is having a great year, and its4-for-1 stock spliton Monday is expected to make the market's most-valuable company even more attractive to a wider universe of retail investors. But the limited history of Apple stock splits says there is no reason to rush in to buy the lower-priced shares.

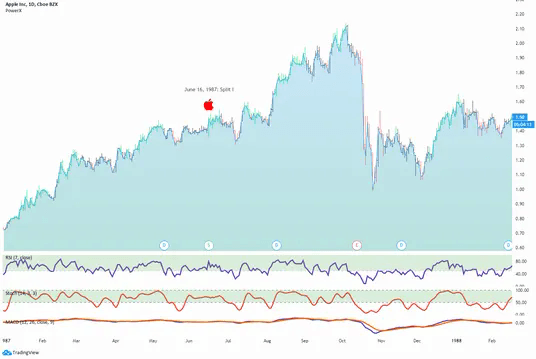

Apple's first stock split occurred on 16 June 1987, seven years after it became a public company, and it was a two-for-one stock split. It kept share prices low enough to make them accessible to investors. Apple's 4 for 1 stock split has taken effect as of Monday, August 31 and analysts are weighing in on how the move will impact the stock's share price. While historically AAPL has seen on average a 10.4% increase 12 months after its stock splits, there are a couple of factors that could hint at stronger than average gains for Apple shares this time around. Silverblatt said companies traditionally courted more retail investors because they were loyal "buy and hold forever" types – which can lend stability to share prices. If that's Apple's strategy, the company is hoping the 4-for-1 split at the end of the month will put a solid floor under its shares at around $100 that would lock in shareholder gains in 2020.

To determine a stock's influence on the S&P 500, you first need to calculate each company's market cap in the index. A simple way to do this is to multiply the number of shares outstanding by the price of each share. Then you add all of those market caps together to get the total market cap of the S&P 500.

Finally, divide each company into the total market cap of the index to get the weighted average. Thus, the larger the market cap of a company in the index, the more impact each 1% change in the stock price will have on the index. And while stock splits can increase a stock's liquidity and make it more accessible for investors, not all companies engage in them.

According to Railey, some companies prefer to keep their stock prices high. An investor buys a share in Apple in January 2005, so they have one share worth $77.00. After the two-for-one stock split a month later, they own two shares in Apple, but each of these shares is worth half the amount, at $38.50. If the shareholder keeps these two stocks until May 2014, they will be worth $1,266 ($633 each) as the stock price appreciates. With the fourth stock split, each of these stocks will then be split seven times, so that the shareholder owns 14 shares in Apple.

Stock divides might not directly increase share prices, but they can often result in higher share prices further down the line. By making shares accessible to new investors, demand can increase, causing the share price to appreciate and the total market capitalisation to rise. While a stock split might be carried out to encourage investment, the split in itself doesn't affect the market capitalisation of a company.

Existing shareholders will own more stocks, but each of those stocks is worth less, so there is no change to the total market value of the company. Apple's financial performance, including its share price, relies heavily on the sales of its products. A high flier through much of its recent history, Apple stock hit new all-time highs toward the end of 2021, with a market capitalization approaching a record $3 trillion.

Dow Jones Industrial average has had many companies in and out over its 136 years' life but Apple's 4-for-1 stock split had rather unusual effect on Dow Jones. As, S&P 500 and MSCI World Index takes the weight of a stock based on its market capitalization, Apple's split did not have much effect on the index. The Dow, instead of using constituents market capitalization, it uses share's share price.

The company says the goal is to make the stock more accessible to a broader base of investors. After this split, they'll be worth $96, but there'll soon be four times as many of them. For one thing, however, many investors don't have access to fractional trading. And many traders perceive higher stock prices as being more expensive.

A $100 share is viewed as more accessible than a $400 one, even if the company has the same underlying market capitalization in both examples. Any company can make its share higher by enacting a reverse stock split, which would reduce the shares outstanding and increase share price. A stock split allows a company to break each existing share into multiple new shares without affecting its market capitalization or each investor's stake in the company. A stock split can be a good sign for both current and prospective shareholders. It seems unlikely that Apple will complete another stock divide in the near future. Share prices are still climbing (they are currently trading at around $186), however shares were worth close to $700 before the last split in 2014.

Apple may consider another stock split if share prices continue to rise, but for now, this move probably wouldn't be in the best interests of the company. This is where split adjusted figures come in – they account for stock splits when working out return on investment. With Apple, stock adjusted figures would acknowledge the fact that one stock bought during its initial public offering would now have become 56 shares. Most trading brokerages also allow retail investors to purchase fractional shares, so splitting to a lower price per share isn't necessary to attract greater retail interest -- but it certainly helps. The lower stock price also makes it more accessible to Apple employees who receive stock-based compensation, in addition to rank-and-file investors who take smaller positions.

Is It A Good Time To Buy Apple Stock Before The Split After Friday's closing bell, Apple shareholders are due the split shares for each existing share of the company that they own. This is applicable for those who were shareholders of record by Aug. 24, though Apple said that those who bought shares between the record date and the time of Friday's split would also be issued split shares. Apple shares officially start trading at the new split-adjusted price at the opening bell of Monday's Nasdaq session. Apple announced its plan for the split on July 30 with its most recent earnings report. In the quarter following the split, shares were up three out of five times. In 2000 and 1987, stock climbed more than 20%, eluding market collapses that were about to come.

In contrast, quarters in 2020, 2014 and 2005 were decently bad, but stock was about to give good return in a matter of time. The news, revealed in Apple's blowout Q earnings report, means investors with one share at close of business on Aug. 24 will be given three additional shares trading at one-fourth the price. It's basically a psychological move that makes Apple stock seem more affordable.

Alphabet will become the most recent high profile company to split their stock in early 2022. The company's 20-for-1 stock split aims to make the share price more accessible to retail investors dropping the price from approximately $2,750 to $140 per share. To determine the Dow's value, you add the price of each stock in the index together and divide it by the total number of companies. Therefore, a company with a higher price will have more of an effect on the index.

Currently , Apple has the highest stock price in the Dow and thus has the most impact on the index when its share price goes up or down. After the split is complete, it will fall to the bottom half of the index, greatly diminishing its influence and have a weighting of about 3%. This, in turn, will increase the relative influence of the other stocks in the Dow. For options, there's the Options Clearing Corporation , which is the central clearer for all options listed in the United States. Its Securities Committee, along with an "adjustment panel" made up of representatives from exchanges, decides whether an adjustment is needed and how it should be structured. "The decision is binding for all investors," Klink explained.

Although adjustments are made on a case-by-case basis, table 1 shows how options are typically adjusted for stock splits. Keep reading to learn how stock splits work, how it affects you as a shareholder, and whether it's worth investing in a company after a stock split. "When we look at a company like Apple and strictly observe the value of an investment immediately after a stock split, there really isn't a discernable pattern in the change in wealth. What is noticeable is the trading volume of the stock which might be attributed to news flow.

The company has previously split its stock four times when its shares have seen significant price increases, as highlighted in the table below. In the first three instances, stocks were split in two when the price was near triple figures. Then, in 2014, share prices rose sharply and a higher split ratio was used. With $33 billion in cash on the balance sheet, in addition to the stock split, the board of directors declared a cash dividend of $0.82 per share of the company's common stock.

The dividend is payable on August 13 to shareholders of record as of the close of business on August 10. Large companies beat collective market expectations of their earnings to positively influence their market capitalization. That they often manipulate their earnings reports to match or beat estimates to artificially enhance their stock prices is no accident.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.